Adval Land Price Index

The Land Price Index is a statistical measure that tracks the changes in the cost of land over a specific period, offering a clear picture of how land values are rising or falling in various regions. Just like inflation indices track changes in consumer prices, the LPI helps stakeholders understand market movements, predict future prices, and make informed investment decisions.

Whether you're a first-time buyer, a seasoned land investor, or simply curious about Kenya’s real estate market, understanding the Land Price Index can offer valuable insights into where the best opportunities lie.

In this blog, we’ll break down what the Land Price Index is, why it matters, how it’s calculated, and what current trends reveal about land investment potential in Kenya.

At Adval Properties, our mission has always been clear: to connect people to properties through technology, trust, and transparency. As Kenya’s most trusted real estate company, we believe that informed decisions start with access to credible, actionable data. In today’s fast-evolving real estate landscape, price trends are constantly influenced by infrastructure development, shifting lifestyles, urban migration, and changing buyer preferences. Whether you're a first-time buyer, a seasoned investor, or a developer planning your next move, understanding regional price dynamics is not just helpful — it’s essential. That’s why we are proud to introduce the Adval Properties Index — a quarterly report analyzing real estate price movements across the country. Powered by data from thousands of listings on our platform and enhanced through the use of AI, the Adval Properties Index offers a clear, data-driven perspective on market fluctuations, helping you make smarter, more confident property decisions. We remain committed to making real estate decisions easier, smarter, and more empowering for every Kenyan. Sincerely, Abdikheir Dubo Chief Executive Officer Adval Properties

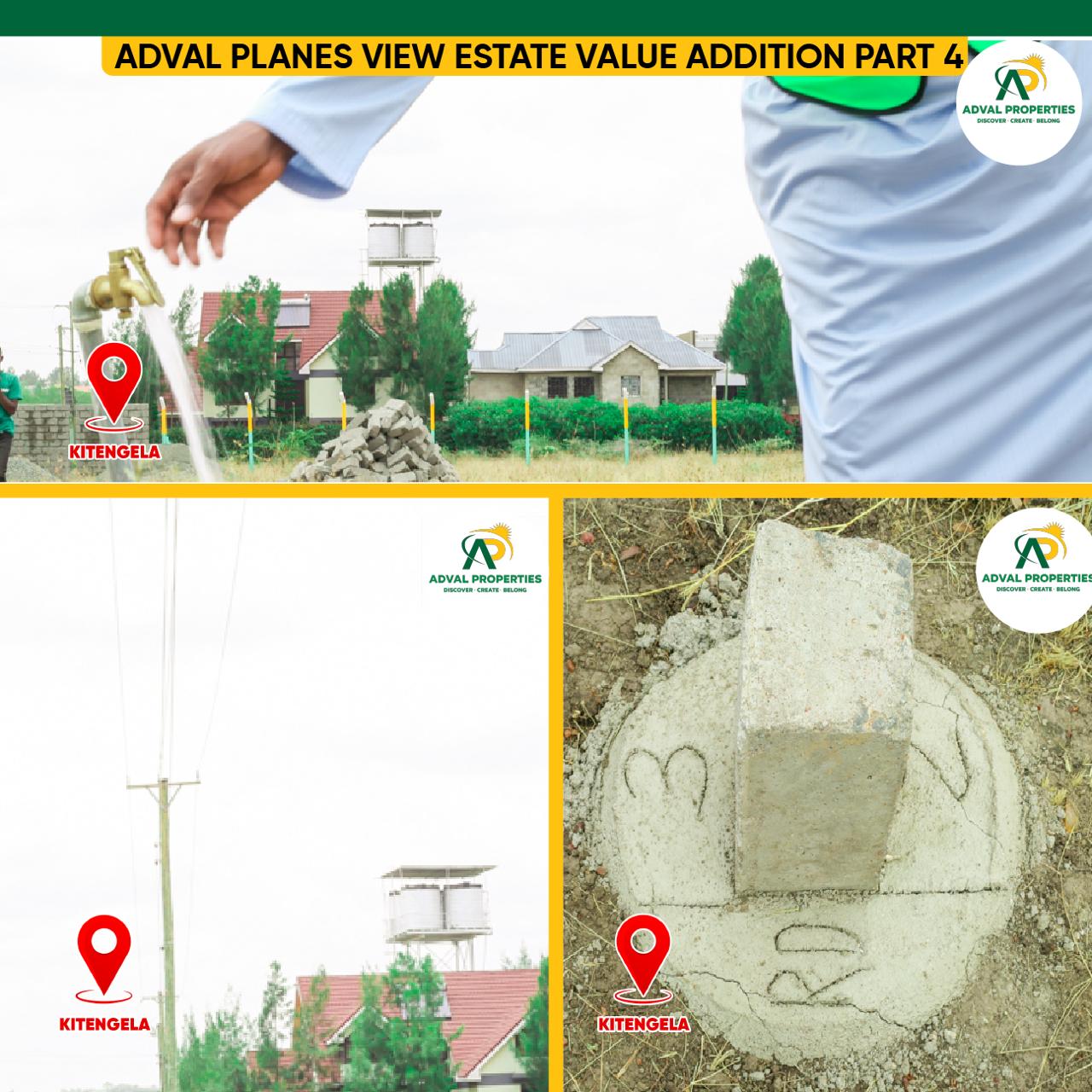

Market Insights from the Adval Properties Index – Q2 Report This quarter’s data reflects key emerging trends that are actively shaping land investment decisions across Kenya. Premium Urban Zones: Nairobi CBD, Eastleigh, and South B recorded the highest average price per acre, underscoring their enduring appeal due to strategic location and robust commercial demand. As central business and retail hubs, land in these areas remains scarce and highly competitive, with prices reflecting continued investor confidence. Rising Residential Hotspot: Kileleshwa registered a notable double-digit price increase, cementing its reputation as a fast-growing residential area. The rise is driven by improved infrastructure, easy access to top amenities, and a wave of redevelopment projects that are redefining the neighborhood's skyline. High-ROI Investment Corridors: For speculative investors seeking strong capital appreciation at more accessible price points, Jogoo Road, Mirema, Rosslyn, Kabete, and Ruiru emerged as high-ROI zones. These areas are characterized by transitioning land use patterns, infrastructure expansion, and increasing residential demand. Kitengela: This peri-urban area continues to attract buyers looking for affordable residential and mixed-use parcels. This quarter, Kitengela recorded a 3% quarter-on-quarter price increase, supported by improved connectivity, the growth of gated communities, and spillover demand from Nairobi and Athi River. The area's balanced mix of affordability and growth potential makes it especially attractive for first-time investors. Kitengela has grown big stretching towards Kisaju. Konza Metropolis: Fueled by ongoing development of the Konza Technopolis and enhanced transport links, land prices in this zone rose by 4% this quarter. As one of Kenya's most ambitious smart city projects, Konza is drawing both domestic and international interest, positioning it as a long-term strategic investment location for tech-driven and institutional buyers

While Konza’s prices are still maturing, it's clear the zone is benefiting from spillover interest in data center and institutional land. Overview Table AreaQ2 2025 QoQ ChangeKey Drivers Kitengela ~2–3% Nairobi spillover, gated communities Konza Metropolis ~2–4% (estimated) Smart city investment, plot uptake Satellite towns avg +8.6% YoY (2023) With enhanced government infrastructure spending, strategic zoning adjustments, and rising diaspora remittances, land remains one of Kenya’s most vital and dynamic asset classes. The Adval Properties Index continues to offer data-driven benchmarks to guide savvy investors in this rapidly evolving property landscape

While Konza’s prices are still maturing, it's clear the zone is benefiting from spillover interest in data center and institutional land. Overview Table AreaQ2 2025 QoQ ChangeKey Drivers Kitengela ~2–3% Nairobi spillover, gated communities Konza Metropolis ~2–4% (estimated) Smart city investment, plot uptake Satellite towns avg +8.6% YoY (2023) With enhanced government infrastructure spending, strategic zoning adjustments, and rising diaspora remittances, land remains one of Kenya’s most vital and dynamic asset classes. The Adval Properties Index continues to offer data-driven benchmarks to guide savvy investors in this rapidly evolving property landscape.